This blog will look at credit card processing for law firms and go quite a bit beyond just credit card payments. We will discuss the value of convenient payment options and how the right payment platform can improve the receipt of payments and customer experience. We will also look at products that offer much more than just a payment platform.

The Benefits of Credit Card Processing for Law Firms

Most businesses and law firms utilize credit card processing these days. Accepting credit cards at both physical locations and digitally is not exactly new.

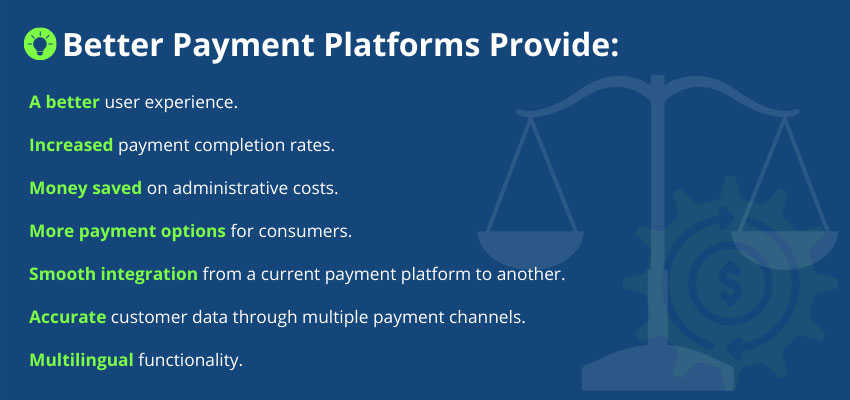

Credit card processing through quality payment platforms offers law firms a variety of benefits. Payment platforms that are designed around user experience can make payments easier for customers. This, in turn, can increase digital payments. This aspect alone can save law firms both time and money by cutting back on administrative costs.

Payment Platform Features that Align with the Needs of Law Firms

Law firms that accept credit cards and debit cards without a doubt make payments more convenient for their clients. But, with the payment technologies of today, merely processing credit cards is just one piece of highly optimized and efficient payment platforms.

Below, we will go into a little more depth about what features make up an optimal payment platform. These features can provide more efficient payment processing for law firms.

User-Experience

The design of a payment platform can make or break the user experience. It can be the determining factor in whether your customers decide to pay you on the web, on their mobile device, or place a call to your customer service department instead.

Payment platforms that are not developed with the end-user in mind will often fall short of delivering an efficient and user-friendly platform. A well-designed payment platform should include input from customers and collectors.

Mobile-First Design

There are figures from both CreditCards.com and Yahoo Finance that state consumers pay roughly half of their bills online through desktops, tablets, and mobile phones. And mobile phone usage seems to be growing.

With the trends as they are, a payment platform with a mobile-first design should be sought after by law firms looking to serve clients who prefer mobile payment methods over other payment methods.

Mobile-first payment platforms are designed specifically with the mobile user in mind. Mobile-first platforms are not just “mobile-friendly” or responsive. They are explicitly designed to make mobile payments more straightforward and more efficient for the end-user – while at the same time offering an excellent experience for consumers using desktops and tablets.

Automatic Payments

A payment platform that allows customers to set up recurring or automatic payments on their own can cut back on late payments and help ensure that law firms get paid on time.

Recurring payment functionality allows firms to work with clients when creating automated payment schedules.

The leading payment platforms will accept a variety of payment methods, including the following:

Payment Methods for Automatic Payments

- Debit cards

- Credit cards

- Prepaid cards and Gift cards

- HSA

Law firms that employ recurring payments may also see a reduction in the resources required to collect on a due debt.

PayWeb360: Not Just Credit Card Processing for Law firms

PayWeb360 is a payment platform designed with the input of the end-user and merchants. PaymentVision utilized surveys to gather feedback about the top concerns of both end-users and merchants. In the end, security, ease-of-use, and speed were among the top concerns, respectively.

PayWeb360 offers many features that can enhance the payment experience for both law firms and their payees.

Since its launch in January of 2021, PayWeb360 has shown payment completion increases of 300% for some clients, with payments being made in 60 seconds or less.

Customer Perspective

From the consumer’s perspective, PayWeb360 is easy to use and allows them to make fast and secure payments. Additionally, the platform has a mobile-first design and is optimal for use on any device.

Client Perspective

Many attorney offices find that PayWeb360 offers seamless integration with their Collection Management Systems (CMS).

PayWeb360 is ready to connect with Vertican, JST, Interprose, and Simplicity out of the box. Which can help save time and money for law offices.

Payment Processing and Data Updates

It is important to note that our new payment platform does not just provide payment processing for law firms. PaymentVision allows clients the ability to accept payments through several different methods while at the same time updating customer data on the backend regardless of the payment method used.

For example, payments made through IVR will accurately update the same record as the payments online. All customer data is carefully managed, updated, and secured. We use patented security technology and exceed all compliance standards for payment processing.

In short, PaymentVision’s PayWeb360 and other payment solutions can process payments and, at the same time, update customer data. And there is no custom development required. These features and functionality are available on delivery.

Multilingual Payment Platform

PayWeb360 is also a multilingual payment platform. By using PayWeb360, law firms are ready serve the Hispanic community instantly. That’s because the payment platform supports Spanish right out-of-the-box. This can be a huge plus for law firms that are processing payments for people are Hispanic. Note, PayWeb360 will also support many other different languages as well.

Credit Card Processing for Law Firms and Optimized Payment Platforms: A Recap

Law firms that accept multiple payment types greatly enhance the experience of their customers. This practice also allows organizations to operate more efficiently. However, payment platforms designed with the end-user in mind that offer a mobile-first solution can drastically increase payment completion rates and reduce the time required to pay.

Law firms looking to enhance their overall payment experience should consider newer platforms that offer more than just processing. With PaymentVision’s PayWeb360, clients can get started offering their customers the best in payment technologies and, in many cases, enjoy easy transitions from current payment systems to ours.

PayWeb360 is also multilingual, ADA compliant, and features smart inputs and tokenized vault security.

If you are interested in learning more about how PayWeb360 can serve and benefit your law firm, contact us for a short demo. We will make payments easier for your customers, increase payment completion rates, and decrease the time it takes to complete payments.