In this blog, we are going to talk in detail about accepting recurring payments. We will look at the benefits of setting up recurring payment options with your customers and key features you should consider when selecting a third-party payment platform that provides the functionality for recurring payments.

What are Recurring Payments?

Recurring payments are payments that are automatically drafted from a customer’s account. With recurring payments, the account holder determines the dates of when the payments are drafted.

There are a wide variety of businesses and organizations that currently accept recurring payments. Today, customers can use recurring payments to automatically pay cable bills, power bills, car payments, and many other types of bills.

Recurring payments are commonly used when paying:

• Utilities

• Car payments

• Insurance premiums

• Memberships

• Subscriptions

• Payment plans

• Nonprofit donations

Why Your Organization Should Use Recurring Payments

Businesses that accept recurring payments often experience many different benefits. These are benefits that traditional billing methods can’t provide.

Below are a few of the benefits of accepting recurring payments.

Convenience

Recurring payments are convenient for both customers and businesses. A customer authorizes automatic payments through a verified account, and the payments are then made on a regular schedule.

Often this is less troublesome for all parties involved. With automatic payments, consumers do not have to worry about being late on payments, and businesses do not have to bother with not receiving payments on time.

Dependability

With automatic payments, organizations can have more confidence in getting paid. Furthermore, recurring payments help ensure that businesses get paid on time, leading to better cash flow.

Saves Time and Money

When a company gets paid and gets paid on time, this saves the organization time and money.

How?

When customers fail to make timely payments, the work required by company employees to recoup the payments they are due can take both time and money. Company employees can spend hours making calls and setting up payment plans that impact cash flow.

Furthermore, automated payments can cut back on the money required to print physical paper statements in some cases.

Customer Data and Security

Recurring payments are safe and secure. With recurring payments, the first-time a payment account is used, it must be verified.

For ACH payments, NACHA requires that routing numbers be validated. Also, NACHA requires that accounts be verified as in good standing.

In most cases, customers may set up recurring payments using any payment method they choose. They can use credit cards, debit cards, prepaid cards, ACH, and HSA. Ultimately though, the types of payment methods accepted are determined by the merchant.

Additionally, the storage of consumer payment information must be secure. Different organizations may use different types of methods and follow different guidelines for ensuring security, but PaymentVision’s products utilize the following to ensure secure payment solutions:

• PCI Level 1 Compliance

• SOC 2 Datacenters

• Tokenized Vault Security

How Does a Business Get Set up with Recurring Payments?

For businesses to accept recurring payments, it is best to shop around for a third-party service.

Today, for many third-party payment platforms that offer recurring payments, implementation is easy. Integration can be seamless, and many of these payment platforms offer customized branding and other convenient and valuable options.

What to Consider When Looking for a Payment Platform

As a business, when looking for a payment platform to meet your payment needs, there are a few key features that you should consider.

The below features of a payment platform can impact everything from payment completion rates to security and compliance. Every feature listed is essential to having an optimal payment solution.

Mobile-First

According to Digital Product Trends, 1.3 billion people are expected to be using mobile payment apps by the year 2023. Additionally, mobile commerce equates to trillions of dollars every year. For this reason, any payment platform a business chooses should not just be “mobile-optimized,” but it should have a mobile-first solution – a payment platform that is not only designed for a desktop but is designed with mobile end-users in mind.

Security

In a recent PaymentVision survey, we found that security was a top concern among mobile-payment users of all ages.

When implementing mobile payment solutions, companies must consider how customer data is used and stored. They must ensure that sensitive consumer information is stored securely.

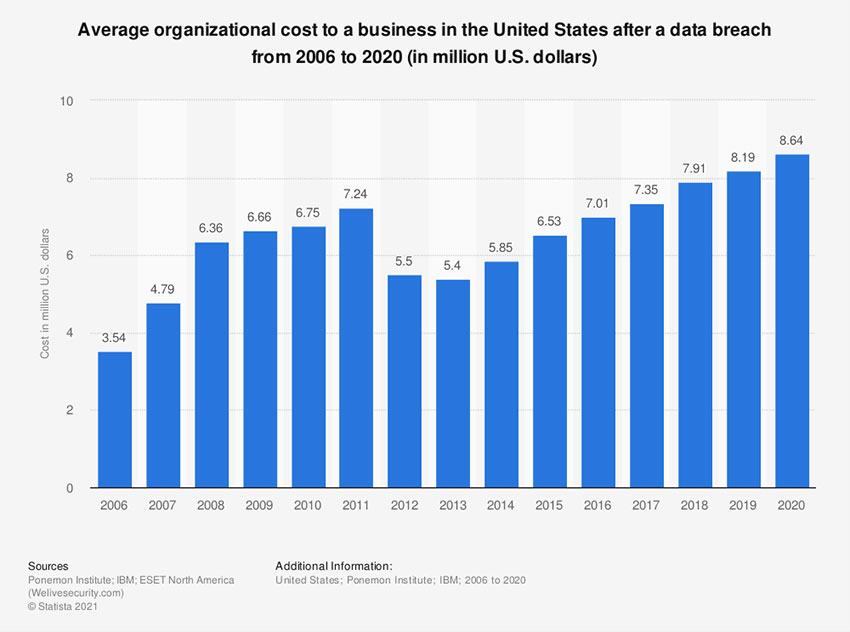

One weak point in a payment system can lead to consumer data being compromised. Moreover, any security breach could be costly for merchants and third-party payment providers, and any security failure would be a PR nightmare.

According to statistics published on Stastista.com from IBM and the Ponemon Institute, the average organizational cost to a business after a data breach is trending upward. In 2020, data breaches cost companies on average $8.64M.

Ease-of-use

As discussed, accepting recurring payments from customers has many benefits. However, if customers find a payment platform to be cumbersome and hard to navigate, they may skip enabling the recurring payments feature in their accounts altogether.

So, as a business looking to find the perfect payment solution, ask for numbers on payment completion rates, bounce rates, client feedback, and other important information when talking to a potential payment solutions provider.

Speed

Speed is closely related to ease-of-use. A slow payment platform can discourage users from paying a bill, which is already not a favorite pastime of most consumers. So, utilizing a payment platform that is secure, easy to use, and fast is essential for a successful bill pay experience.

Compliance

Compliance is a feature where shortcuts are not an option. Payment systems must be NACHA compliant, PCI compliant, and ADA compliant. These considerations should be standard for any quality payment platform allowing for recurring payments. Not only does being compliant help protect consumers, but it helps protect businesses as well.

Accepting Recurring Payments: A Recap

In this blog, we discussed recurring payments. Today, many customers appreciate the convenience of automated bill pay. They use automatic payments to pay bills for utilities, automobiles, and payment plans, among other things.

Not only can consumers enjoy the benefits of recurring payment functionality, but businesses can, too.

Businesses that use payment platforms that offer automated payments can experience more prompt and timely payments increasing cash flow. Also, automated payments can save organizations time and money by reducing the resources needed to seek amounts that are owed.

When selecting a payment platform, businesses should consider mobile functionality, security, user experience, speed, and compliance.

PaymentVision offers a mobile-first payment platform called PayWeb360. It is simple, secure, and fast. Some clients are experiencing payment completion rates of 300% with PayWeb360. Statistics for PayWeb360 also show that customers are completing payments in 60 seconds.

PayWeb360 features and stats:

- Custom Onboarding

- Linked Accounts Support

- 82.5% Increase in Payment Start Rate

- 92.2% Decrease in Bounce Rate

- 300% Increases in Payment Completion Rates

- Payment Completion within 60 Seconds

- Multilanguage Support

- Smart Inputs

- Three Click Payment Functionality

- SMS Text Notifications

- SMS Text Payments

- Open API

- PCI Level 1 Compliance

- SOC 2 Datacenters

- Tokenized Vault Security

- 99.9% Uptime

Get a demo of PaymentVision’s mobile-first payment platform by clicking here.