In this blog, we are going to talk about payment gateway providers. The purpose of this information will be to outline key features and actions companies should take to create optimal and successful payment solutions.

What is a Payment Gateway?

A payment gateway is a system that allows for the collection, processing, and settling of financial transactions. The payment gateway is comprised of a collection of capture channels that will enable a payor, the consumer, to make a payment to the payee, the merchant. Various payment capture channels include point of sale devices, phone payment solutions, online payment platforms, or functionality that allows payments through mobile devices and by text.

The payment gateway process allows the merchant to collect a consumer’s payment and transmit it through the payment network, where it can be processed and settled. The process ensures that funds are correctly transferred from the appropriate customer account to the designated merchant account.

A payment gateway will allow multiple payment methods to include checks, ACH, debit cards, credit cards, gift cards, and mobile wallets.

Being a Successful Payment Gateway Provider: The Checklist

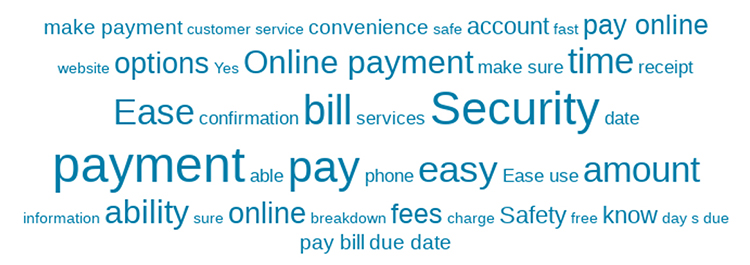

We’ve carefully researched and compiled data from our own survey of 268 consumers. The info from our survey is directly correlated with and often supports many of our recommendations in the tips listed below.

1. Ensure a Flawless User Experience in Payment Gateways

A flawless user experience starts with and centers around understanding your consumer, the end-user. User experience requires payment gateway providers to design platforms with an understanding of what the consumer is trying to accomplish, uncovering the user’s genuine need and potential pain points.

How will the consumer use your payment platform, interact, and what is the user trying to do?

Building a flawless user experience requires building empathy around the user’s expected experience. In general, no one likes paying their bills and sending their hard-earned money to someone else. However, the user understands the necessity of paying for goods and services used.

The user experience must be designed to reduce friction in the payment experience but ensures the actions completed are clear and understandable to the user.

When a user logs into your payment platform, do you require them to reenter the information you already have on file? If so, this may annoy your user. This point of friction creates an opportunity for the user to fall out of the payment funnel. Prefilled information can be incredibly important in the payment gateway experience.

Prefilled Information: Optimizing the Experience of a Payment Gateway

As the merchant, you know what you are billing customers. So, optimize your payment gateway functionality—prefill payment amount fields, but make the field editable in case the user wants to change the payment amount to fit their budget.

As a merchant, you also know the account numbers of customers, prefill this field as well.

If the user has already made a payment, store the payment information securely and compliantly present the user’s payment method information. This step fosters ease-of-use for customers and helps create a more pleasant payment experience.

As a merchant, you have sent the consumer a bill; you have their address. This creates another opportunity to lighten your customers’ load by simply prefilling address data into a field.

By implementing something as simple as prefilling customer data fields, the user only needs to review their information for accuracy. If an update is required, the user can then update the one data field versus completing all fields. This is an example of a powerful capability that helps create a flawless experience for the user, reducing the change for payments funnel fallout and improving the rate of payment capture.

Using a human-centered design approach will help align with user expectations.

Does your platform use internal jargon or conversational language? By surveying and testing your designs with end users, you can gain insight into the terms you should use.

In a recent user test, we found out that our internal term for an automatic payment was only recognizable by 4 in 10 users. However, the end-users survey recommended a term that was known by 9 in 10 users.

Using language that aligns with your user’s expectations can increase the rate of adoption significantly. The more you align your product with user expectations, the less training is needed by the end-user.

In short, payment gateway platforms should be efficient, user-friendly, and provide functionality that allows for ease-of-use so that end-users do not fall out of the payment channel.

2. PCI Compliance is Critical

While user experience is a critical differentiator in a payment platform, your payment platform must be PCI compliant. PCI is the governance standards for the way you store, secure, and process payment card information. By following these standards, the merchant reduces the risk of data breaches and compromises. This can improve a user’s confidence in your payment gateway solution.

PCI compliance includes:

- Restricting access to payment card information

- Guidance on how to securely store payment card information

- Testing standards to monitor the performance of your platforms

3. Make Sure Payment Gateways Follow ADA Guidelines

Is your company developing a payment platform solution for all users? If so, you must be ADA compliant. If not, you’re excluding a significant portion of your consumer base. On top of that, you are increasing your risk of a lawsuit.

In 2017, a blind man named Juan Carlos Gil sued Winn-Dixie for ADA violations on their website. And, the judge ruled in Gil’s favor. Although Gil wasn’t financially compensated, Winn-Dixie was required to make significant improvements to their website to make it ADA compliant. This cost the company time and money.

With any online payment channel, abiding by ADA guidelines is essential. And adopting WCAG level AA guidelines seems to be the standard for most websites. Implementing the rules of the WCAG Level AA guidelines into the design of your payment gateways can significantly benefit the visually impaired.

Focusing on color and ensuring that colors don’t drive end-user actions. Also, with WCAG AA guidelines, fixing screen orientation to portrait or landscape should be avoided. Other WCAG AA rules include identifying input purposes on fields and the proper use of headers.

Implementing ADA requirements into the user experience is the right thing to do, dramatically helps the visually impaired, and is the law.

4. Design Your Payment Gateway Platforms for Mobile

Did you know that over 60 percent of Americans use their mobile device to complete financial transactions? Did you know that over 80 percent of Americans under 25 are using their mobile devices to complete a financial transaction?

Is your company’s payment gateway optimized for mobile? If not, you are missing out on a large portion of the market.

Mobile users incorporate their mobile devices into many different aspects of their daily lives, including making payments through mobile payment gateways. For a payment platform to be effective, it must be present and designed for the mobile device.

Perceptions are reality. If your company is not available through mobile devices, users may perceive your solutions to be out of date, old-fashion, or unreliable. While we all recognize that no consumer is using MS-DOS anymore, it should be just as clear that users expect an intelligent mobile solution.

Mobile payment solutions allow merchants to meet the consumer’s need for convenience, choice, and flexibility.

5. Omnichannel or Integrated Experience across the Breadth of Channels

A single channel payment solution is no longer acceptable. Consumers expect choices.

Consumers require the merchant to provide a capability in the channel that they use. While we talked about mobile being a growing channel. There is still a use case for online (desktop), in-person payments, over-the-phone payments in a call center, or through an IVR (integrated voice response). And, there are emerging channels related to text message and webchat.

Does your payment gateway platform have the integrated ability to present and interact with the consumer in a consistent experience across various channels—IVR, pay-by-text technology, mobile apps?

6. Don’t Compromise on Security

Hackers attack every 39 seconds. On average, roughly 2,244 times a day, according to experts. For this reason, and other reasons we’ll discuss below, we can see why security is a top concern for many consumers when paying their bills.

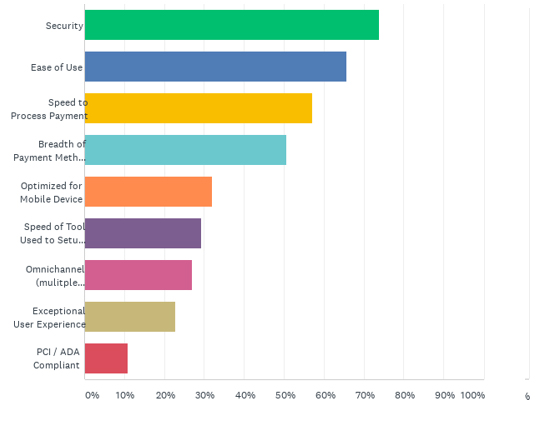

Q3: As a bill payer, when you make a payment, which consideration(s) or capability(s) are important?

In recent years, Americans have seen news reports of data breaches and all-out hacking against major financial institutions. Banks like Wells Fargo and Bank of America have been targets, and the popular payment platform PayPal has been as well.

From the technical perspective, payment gateways must always have secure logins. They must incorporate single sign-on solutions that can withstand and combat malicious attacks on their systems.

And, to take logon security a step further, many payment platforms now offer multi-factor authentication (MFA).

Multi-factor authentication provides secure single sign-on functionality and provides an additional layer of protection via a second security check.

Examples of multi-factor authentication might be verification of account ownership with a fingerprint, a PIN, or a code delivered by text or email.

However, even with a technically sound payment gateway, consumers can still fall victim to hackers who manipulate victims and ultimately convince them to give up sensitive data about their accounts through phishing attacks.

For the payment transaction itself, the tokenization of payment information can be imperative in facilitating the security level needed to build trust with consumers and protect payments.

With our Pay by Text technology, PaymentVision uses tokenization. It’s a technology created and patented by PaymentVision.

This technology protects data as the payment is processed directly through PaymentVision’s PCI level one certified payment gateway. The data is immediately tokenized, removing risk for the exposure of financial data.

7. Communicate Effectively

If this point could be summed up in a phrase, that phrase would be, do what you agree to do.

As this relates to communication, this would mean communicating with consumers as agreed—interacting to meet customer expectations and serving the purpose.

For example, consider a payment gateway like pay-by-text. Not only should consent be obtained before any text communication, as required by the TCPA, but the reasons for communication should be defined for the customer.

Defining expectations and meeting them is a great way to build trust with the end-user.

8. Amplify Your Companies Multiple Payment Options

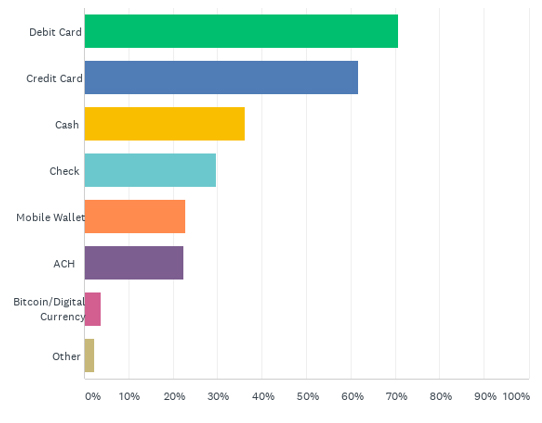

The effectiveness of a company’s payment gateway is impacted by the flexibility of their payment methods and payment channels available to consumers. Just offering one payment method can limit collection potential.

Having more than one payment gateway for customers can improve convenience, customer satisfaction and save companies money. And, from our survey results, you can see on the graph below which payment methods and platforms consumers value.

Q7: Which payment methods are most important to you in order to make a payment?

For example, if, as a company, your receipt of payments has historically been by customers paying with check or cash at a physical location. Imagine how pay-by-text, IVR, a mobile payment application, or an online payment platform could impact your bottom line.

And to make a case for mobile payment options, 96% of all Americans have a cell phone of some kind. Additionally, research from the Motley Fool shows that 69% of cell phone users find contactless payments more convenient than transactions involving paper money. And from the trends we see, digital payment options and cashless payments are continuing to trend upward.

In short, offering more payment platform options delivers convenience to customers. And by providing different payment options, customers may adopt payment methods that save companies time and money.

Consumer Payment Methods

- Cash

- Check (capture electronically) – remote capture via a mobile device

- ACH – Electronically from Bank Account

- Credit Card

- Debit Card

- Mobile Wallet Integration

- Gift Cards

9. Follow NACHA Guidelines

The NACHA guidelines of March 2021 come as a result of merchant feedback to NACHA over the years.

Before the March 19, 2021 update, only a basic routing number check was required for ACH payments to be processed. As of March 19, 2021, the NACHA account verification process will be more involved in the frequently used payment gateway, ACH.

The March 2021 NACHA rules will require all merchants who accept ACH to have “commercially reasonable” processes that validate both routing numbers and the customer’s identity and verify that an account is in good standing.

Benefits and Impacts of NACHA Rules on ACH Payments Gateways:

- Reduced fraudulent entries

- Improved fraud detection

- Limited impact of fraud

- More development time for certain payment processing companies

Several different methods will allow for account verifications. However, not all are as efficient. Below we’ll take a quick look.

Options for Account Verification

- Micro deposits – Effective but can take days.

- Prenotification – A useful option but can take days and is dependent on the customer.

- Third-party instant verification – Reliable and fast.

PaymentVision’s third-party account verification technology goes above and beyond NACHA compliance for ACH payment gateways. We offer real-time account verification, identify verification, and owner authentication all at once. Simultaneously, we scan accounts for recent NSFs, assess accounts for any prior history of fraud, account abuse, and forgery, among other malicious activities that would flag an account as risky.

10. Watch the Trends

In technology, trends can change in a flash. For example, think of social platforms over the years, AOL, MySpace, Facebook, Twitter, Instagram, TikTok. How we connect has come a long way.

And with cell phones, remember the big bags with phones? Remember the flip phone? What about Blackberry?

Paying attention to trends in the market can help companies plan better, react sooner, find opportunities, and be first to enter the market with products, services, and new technologies.

When it comes to payment gateway technology, it’s no different. Tracking shifts in consumer behavior, monitoring new security concerns, and aligning your organization with new rules and regulations are just a few areas that can significantly impact payment platforms.

11. Get Feedback, Test, and Refine Payment Gateways

Technology is constantly in motion. It’s necessary, and the fluidity of technology can often result in a better product.

With payment gateway platforms, collecting end-user feedback, testing, and refining work together to improve efficiency and build better relationships and experiences for the end-user.

Receiving feedback from customers and end-users is priceless. We already know that understanding the end-user is where designing the user experience begins, but it doesn’t end there.

By implementing communication channels that allow the end-user to share their experiences and concerns, pain points can be addressed and resolved—companies can truly gain the perspectives of those they look to serve. And often, companies can even uncover new opportunities.

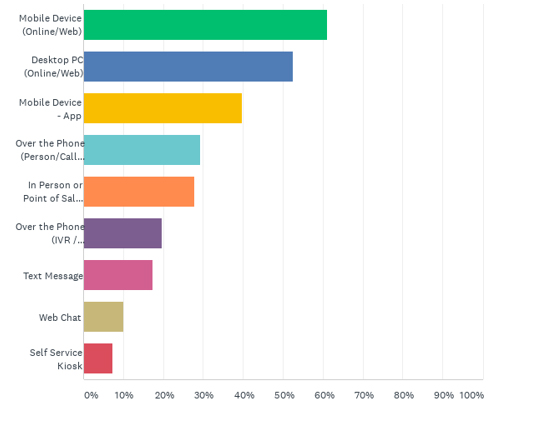

12. Mobile Apps, Responsive Design and Speed

Consumers move fast these days, and they also expect things to be fast. Americans want their cell phones, computers, and apps to perform efficiently and with speed always.

Speed isn’t just a nice-to-have either. It’s pretty much a must-have. One indicator of this is that the search engine Google looks at site load-speed as a ranking factor for ranking websites.

Basically, if your site is slow and inefficient, it’s going to get dinged by Google’s website indexing algorithm.

The Data On Mobile Consumers

As mentioned above, 96% of all Americans have a cell phone, and 69% of cell phone users find cashless payment gateways more convenient than paper money. Additionally, of those Americans who own a mobile phone, over 80% browse the internet with their mobile phone. These numbers are only projected to go up. And, as you can tell from our survey, consumers clearly show their interest in having the ability to make a payment with their mobile phones.

Q5: Which channels are most important to you in order to make a payment?

Consumers have quickly adopted payment apps to pay each other and use branded mobile apps to pay their bills via their cell phones.

But, why not just incorporate an online payment gateway as a part of your mobile website and be done with it? Isn’t this just the same?

No. It’s not.

The Journey to Mobile App Adoption

Yes, having a responsive website is indeed expected by the end-user. It’s par for the course. But getting your consumers and potential customers to download your mobile app usually begins through the web because that is where they find you via searching.

Suppose you can earn the trust of potential customers and end-users on your website. In that case, you might push consumers further along the customer journey into eventually adopting a branded payment gateway like a mobile app.

Mobile apps build brand awareness. They build customer engagement, give companies a direct line to consumers through push notifications, and allow them to connect through different avenues. And, to top it off, mobile apps are faster payment channels.

13. Utilize a Platform that Supports Spanish Speaking Customers

According to Babbel.com, the United States has more than 43 million people who speak Spanish as a first language. That is a lot of people—about 13% of the population.

With these numbers in mind, providing a payment platform that offers bilingual functionality could make sense for many organizations. And today, PaymentVision’s PayWeb360 payment platform offers bilingual capabilities right out of the box.

14. Account Updater Functionality

Outdated credit card information can delay the receipt of on-time payments for many organizations. Today, the leading payment processing platforms provide an account updater.

Account updater functionality allows companies to automatically update credit cards that are expired or lost. This feature also helps reduce strain on customer service centers and improve consistent cash flow through on-time payments. Account updater is another important feature provided by leading payment gateway providers.

Payment Gateway Provider Tips: A Recap

In its most basic definition, payment gateways are various channels that allow a consumer to make payments to a person or organization. Examples of payment gateways include checks, ACH, credit cards, pay-by-text, and mobile wallets.

For a payment gateway to succeed, many aspects must be focused on—many moving parts must work together simultaneously to deliver a secure, efficient, and seamless payment experience.

Not only do customers expect speed and ease-of-use, which is an essential ingredient for ensuring consumers don’t fall out of the payment channel, but customers also prefer the flexibility of having multiple ways to make their payments. This can often benefit many companies who can eventually save money with payment options that are more cost-efficient and less taxing on the organization.

Organizations should always be at the forefront of trends—looking for what’s coming next. Being proactive can allow companies to react positively—quickly adjust, discover new opportunities, and be the first to market.

As organizations grow, a critical piece of successful payment platform design includes open communication with consumers. Gathering feedback and qualitative data can lead the way to improve products and services.

Also, following government laws and regulations are an essential piece of developing better payment platforms. ADA guidelines can help those with disabilities. And ensuring PCI compliance and following NACHA guidelines can help protect consumers and build trust.

PaymentVision’s products, like PayWeb, Pay API, Pay IVR, and PV Mobile, offer secure payment methods for companies looking to provide customers with payment flexibility. Implementation is effortless, customizable, and cost-efficient.

Ready to chat more about better payment options—payment solutions that could save your company money, increase payment capture rate, and make payments easier for your customers? Let’s chat.