PayWeb360 v1.3 is now available in production. The purpose of this release is to add 5 new features (Bank Account Verification, Notification Subscriptions, Account Detail Notice, Allow Zero Balance, Unique Visitor ID), 34 new User Events, 11 ADA Enhancements and 9 bug fixes.

Bank Account Verification

Bank Account Verification is a feature of PayAPI, PayAgent, the Customer Enrollment website (a.k.a. Hosted Tokenization) and PayWeb 2 that enables merchants to verify that bank accounts are open and in good standing prior to accepting a payment. Now, as part of this release, merchants can do the same within PayWeb360.

How does it work?

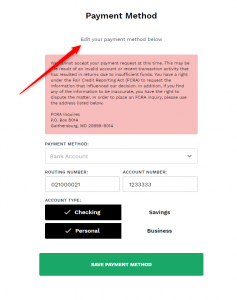

- User enters an invalid bank account and clicks Save Payment Method on the Add Payment Method screen

- PayWeb360 submits an AddBankAccount request to PayAPI

- If a BankAccountVerificationFailed error response (5055) is returned then PayWeb360 presents the following disclosure

What are the use cases?

Bank Account Verification has the following use cases:

| Use Case | Description |

|---|---|

| ACH Return Rate Management | NACHA has established an inquiry process which is triggered when an ACH originator exceeds a return rate threshold*. This can be problematic for subprime merchants, particularly those who enroll customers in auto debit. |

| WEB Entry Account Validation | Effective March 19, 2021, NACHA is requiring bank accounts to be validated as part of a commercially reasonable fraudulent transaction detection system for WEB debit entries. |

NACHA Return Rate Thresholds

NACHA has established the following ACH return rate thresholds:

| Category | Reason Codes | Limits |

|---|---|---|

| Unauthorized debit entries |

| .5% |

| Administrative returns |

| 3% |

| Overall returns | All | 15% |

Implementation

Bank Account Verification can be enabled by reaching out to your PaymentVision Relationship Manager.

Notification Subscriptions

Notification Subscriptions is a feature of PayWeb 2 that enables customers to subscribe to both text notifications and text payments. Now, as part of this release, merchants can do the same within PayWeb360.

How it Works

- Customer launches PayWeb360

- If the customer is not enrolled in text notifications then a red dot will be presented on the User Profile icon as a visual queue that something is missing on their account

- Customer clicks User Profile icon

- If the customer is not enrolled in text notifications then a call to action is presented on the User Profile page

- Customer clicks Turn notices on link within the call to action

- PayWeb360 presents a Phone Registration screen. Note: If the customer has a phone number on file then the phone number field will be pre-populated

- Customer updates phone number, if needed, checks the consent box and clicks Continue

- PayWeb360 sends a verification code to the device and presents a Device Verification screen

- Customer enters verification code and clicks Continue

- PayWeb360 present User Profile page with Subscriptions enabled

Use Case

Comply with the Fair Debt Collection Practices Act, Telephone Consumer Protection Act and CTIA Messaging Principals and Best Practices

Dependency

In order for a customer to receive a text message as part of a notification subscription, the merchant must have an active notification rule within the PaymentVision Portal.

Account Detail Notice

Account Detail Notice is a new message that can be presented on both the Account Detail and Verify Payment screen. The contents of the message are configurable at the site tenant level.

Allow Zero Balance

Allow Zero Balance is a new configuration option that can be used to change the way in which the Total Balance and Current Payment Amount are handled.

| Setting | Behavior |

|---|---|

| False (Default) |

|

| True |

|

Unique Visitor ID

Unique Visitor ID is a new metric that will help track the number of distinct individuals using the site. The purpose of the new metric is to better understand user behavior and identify opportunities to improve the user experience.

User Events

PaymentVision added the following User Events, as part of this release, in order to provide more visibility into user activity.

- UniqueVisit

- LoginSuccess

- LoginFail

- PaymentStarted

- PaymentCompleted

- PaymentFailed

- WeeklyScheduleSet

- MonthlyScheduleSet

- SemiMonthlyScheduleSet

- AddACHPaymentMethodSuccess

- AddACHPaymentMethodFail

- EditACHPaymentMethodSuccess

- EditACHPaymentMethodFail

- AddCCPaymentMethodSuccess

- AddCCPaymentMethodFail

- EditCCPaymentMethodSuccess

- EditCCPaymentMethodFail

- DeleteACHPaymentMethodSuccess

- DeleteACHPaymentMethodFail

- DeleteCCPaymentMethodSuccess

- DeleteCCPaymentMethodFail

- SMSRegAndSubSuccess

- SMSRegAndSubFail

- SMSUnRegAndUnSubSuccess

- SMSUnRegAndUnSubFail

- UpdateCustInfoSuccess

- UpdateCustInfoFail

- NoScheduleSet

- AddDebitPaymentMethodSuccess

- AddDebitPaymentMethodFail

- EditDebitPaymentMethodSuccess

- EditDebitPaymentMethodFail

- DeleteDebitPaymentMethodSuccess

- DeleteDebitPaymentMethodFail

ADA Enhancements

- Added the tenant company name to the alt text associated with the logo

- Changed the structure of the page title tags to include the tenant company name in addition to the page name

- Made the Show/Hide password icon within the Login page keyboard focusable

- Changed subheading tags on the Dashboard page from <h3> to <h2>

- Changed logo within the header to link to the Make Payment page when clicked within any other page

- Improved payment method error messages and input masking

- Added escape key support to the material design modal

- Replaced the material button on the Payment Date Calendar with arrows

- Made the Fee Info icon on the Verify Payment page keyboard focusable

- Added error message to modify contact info page for incorrect information

- Added a label to the Address Line Two field on the Modify Contact Info page

Bug Fixes

| Issue | Description |

|---|---|

| Payment Plan Set-up Warning | Old Behavior: When a linked account is setup with a payment plan, The Make Payment page presents a Payment Plan Set-up warning for all linked accounts regardless of whether they, themselves, have been set-up with a payment plan. New Behavior: The Make Payment page only presents a Payment Plan Set-up warning for an account if it is setup with a payment plan. |

| Same Day Payment Sorting | Old Behavior: Same day payments are not presented at the top of the list within both the History page and Recent History panel on the Dashboard. They are also not being presented as the Previous Payment within the Account Detail screen. New Behavior: The most recent payment is always presented at the top of the list within both the History page and Recent History panel on the Dashboard. The most recent payment is always presented as the Previous Payment within the Account Detail screen. |

| Deleted/Created Payment Plans | Old Behavior: When a payment plan is either deleted or created for a packeted account, it is not reflected on the Dashboard until the user logs out and logs back in. New Behavior: Payment plan updates are reflected immediately on the Dashboard. |

| Packet Payments | Old Behavior: Clicking the Make Payment menu option from within the detail of a packeted account initiates the payment process for the packeted account instead of at the packet level. New Behavior: Clicking the Make Payment menu option from within the detail of a packeted account initiates the payment process at the packet level. |

| Payment Method Type | Old Behavior: When viewing a payment plan within the Account Detail screen, “Credit Card” is presented as the payment method in cases where a debit card was used. New Behavior: When viewing a payment plan within the Account Detail screen, “Debit Card” is presented as the payment method in cases where a debit card was used. |

| Payment Date Changes | Old Behavior: Clicking the Make Payment menu option after changing the payment date within the Make Payment page clears out the payment date. New Behavior: Any changes to the payment date are retained when clicking the Make Payment menu option. |

| Verify Payment Refresh | Old Behavior: Refreshing the Verify Payment page loads a blank Make Payment page. New Behavior: Refreshing the Verify Payment page re-loads the Verify Payment page. |

| No Payment Due | Old Behavior: When no payment is due “$0.00 due today” is presented on the Make Payment page. New Behavior: When no payment is due “$0.00 due today” is not presented on the Make Payment page. |

| Customer Account Mismatch | Old Behavior: When a customer back clicks to the Login page and logs in to another linked account the new session retains the account information from the previous session. New Behavior: When a customer back clicks to the Login page and logs in to another linked account the new session loads the account information associated with the new login credentials. |