PayWeb v.1.5.3.478 is now available in production. The purpose of this release is to add Bank Account Verification.

Bank Account Verification

Bank Account Verification is a feature of PayAPI, PayAgent, and ValidPay that enables merchants to verify that bank accounts are open and in good standing prior to accepting a payment. Now, as part of this release, merchants can do the same within PayWeb 2.

How does it work?

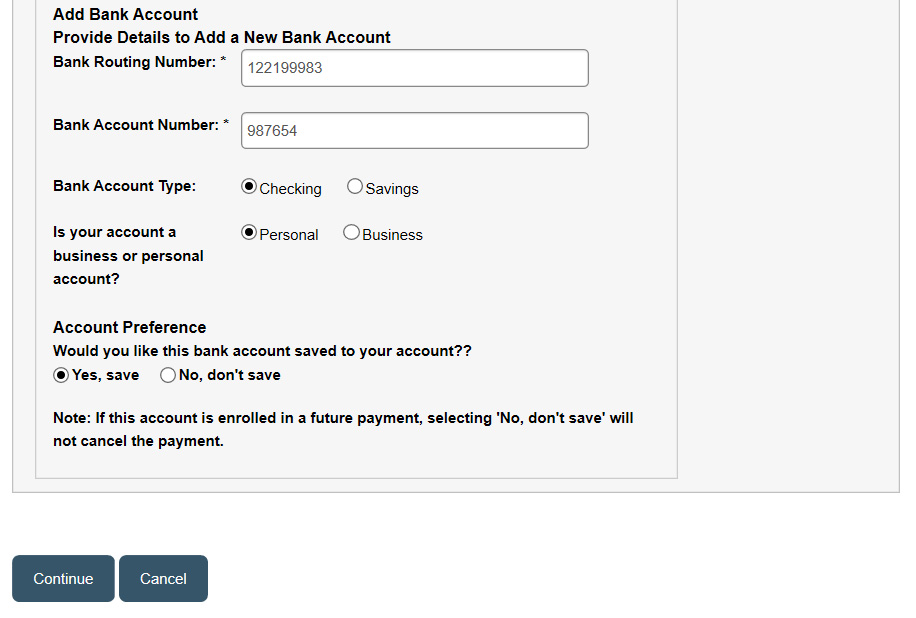

- User enters an invalid bank account and clicks Continue on the Make Payment page

- PayWeb 2 submits an AddBankAccount request to PayAPI

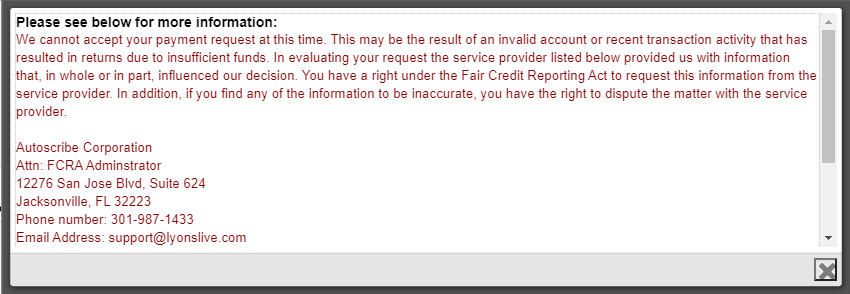

- IF a BankAccountVerificationFailed error response (5055) is returned THEN PayWeb 2 presents the following disclosure

What are the use cases?

Bank Account Verification has the following use cases:

| Use Case | Description |

|---|---|

| ACH Return Rate Management | NACHA has established an inquiry process which is triggered when an ACH originator exceeds a return rate threshold*. This can be problematic for subprime merchants, particularly those who enroll customers in auto debit. |

| Use Case | Description |

|---|---|

| WEB Entry Account Validation | Effective March 19, 2021, NACHA is requiring bank accounts to be validated as part of a commercially reasonable fraudulent transaction detection system for WEB debit entries. |

*See NACHA Return Rate Thresholds below for more information.

NACHA Return Rate Thresholds

NACHA has established the following ACH return rate thresholds:

| Category | Reason Codes | Limits |

|---|---|---|

| Unauthorized debit entries | • R05 – Unauthorized Debit to Consumer Account Using Corporate SEC Code • R07 – Authorization Revoked by Customer • R10 – Customer Advises Unauthorized, Improper, Ineligible, or Part of an Incomplete Transaction • R29 – Corporate Customer Advises Not Authorized • R51 – Item Related to RCK Entry Is Ineligible or RCK Entry is Improper | .5% |

| Administrative returns | • R02 – Account Closed • R03 – No Account/Unable to Locate Account • R04 – Invalid Account Number Structure | 3% |

| Overall returns | All | 15% |

Implementation

Bank Account Verification can be enabled by reaching out to your PaymentVision Relationship Manager.