PayWeb 2 v.1.3.35 is now available in production. The purpose of this release is to introduce Wallet Management.

Wallet Management

Wallet Management is a new set of functionality that enables users to manage how financial accounts are both used and presented within a customer wallet. The new set of functionality includes Financial Account Storage Preference, Financial Account Deletion, and Last Used Financial Account.

Financial Account Storage Preference

Financial Account Storage Preference enables a user to specify how they would like a financial account to be stored within the system.

How it Works?

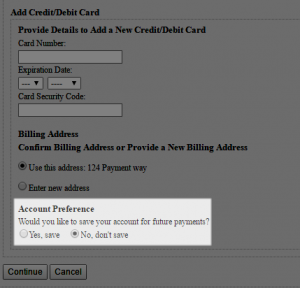

- When a financial account is added to the system, it now prompts the user if they would like the financial account to be available for use in future payments as highlighted within the screen shot below.

- If the user opts out, the financial account is immediately unregistered after it is used. If the user opts-in, the financial account remains registered

- When any PaymentVision or integrated payment application retrieves a list of financial accounts for that customer, only registered financial accounts are returned

Use Cases

- Meet the expectation of someone making a payment on-behalf of the customer (e.g., a parent or friend)

- Reduce debt collection compliance risk

Financial Account Deletion

Financial Account Deletion enables users to remove a financial account from a wallet.

How it Works?

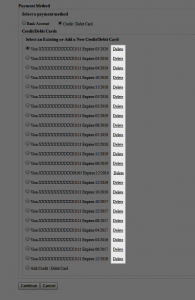

- User deletes the account from within the Make Payment page, as highlighted within the screen shot below.

- If the account is associated with any pending payments, the system blocks the request and presents an error message

- If the account is not associated with any pending payments, the system verifies the request

- User selects okay

- System presents confirmation.

How it Differs from Retire?

Unlike a financial account that has been retired, an un-registered account cannot be re-activated unless it is re-introduced into the system.

Use Case

Removing financial accounts that are no longer in active use eliminates “noise” and avoids accidental use. Sub-prime lenders have a particularly strong use case for this, where borrowers frequently pay with pre-paid cards and acquire a large collection of them during the course of a loan.

Last Used Financial Account

Last Used Financial Account presents financial accounts based on when they were last used.

How it Works?

When presenting payment options, the system now presents a customer’s wallet in order of last use and defaults to the last used account.

Use Case

Reduce friction by making it easier for users to complete a payment