PayWeb 2 v.1.3.32 will be available in production on May 11, 2016. The purpose of this release is to introduce one new feature (Payment Cancellations) and three new configuration options (Recurring Payment Mode, Recurring Schedule Start Day Picker, and First Payment Date Min/Max).

Payment Cancellations

Payment Cancellations is a new PayWeb 2 feature that enables a customer to cancel payments online.

Highlights

- Payment Cancellations can be enabled or disabled at the site level

- Customer can cancel a one-time payment or all remaining payments in a series

- If a payment is part of a series, the system warns the customer and provides the option to cancel the remaining payments in the series

How does it work?

- Customer looks up payment history

- If the merchant is configured to allow online payment cancellation and a payment is pending, an x icon will appear next to the payment

- If a customer requests to cancel a payment and the payment is part of a series, the system will warn the customer and provide the option to cancel all remaining payments in the series or just the one.

- System verifies the payment cancellation request.

- System confirms the payment cancellation request and provides the option to set up a new payment

Use Case

The new feature was original designed as a solution for a company offering a revolving credit product where a customer’s monthly payment obligation changes as additional pieces of furniture are added to the loan. We anticipate this feature will be useful for other companies who want to provide their customers with the ability to self-manage payments.

Recurring Payments Mode

Recurring Payments is an existing PayWeb 2 feature that enables customers to pay a balance over time by creating a series of payments. In this release, we have added a new mode that replaces the existing total amount panel with a new recurring amount panel. The purpose of the new panel is to enable customers to select or define a recurring amount as opposed to a total amount to be paid over time. The recurring amount is then used as input, along with a frequency and End Criteria (fixed total amount or user-defined end date), to construct the series.

Highlights

- Recurring Payment Mode and End Criteria (Fixed Total Balance, End Date, Both) can be configured at the site level

- Recurring Payment Modes include the ability to specify a recurring amount or a total balance to be paid over time

- Frequency Options (Weekly, BiWeekly, Monthly, SemiMonthly, Quarterly) can be configured irrespective of Recurring Payment Mode

How does it work?

- Customer defines a recurring amount or selects an amount (e.g.; Monthly Minimum Payment) sourced from a customer information upload

- Customer selects a frequency from a configurable list

- Customer selects a fixed total amount or a user-defined end date

- System automatically creates a series of payments based on the input gathered in steps 1 – 3.

Use Case

The new feature was original designed as a solution for a company offering a revolving credit product who wanted to simplify the process of setting up a recurring payment. We anticipate this feature will be useful for other companies who’s customers have periodic payment obligations on fixed or revolving principal balances where it is more appropriate to specify a recurring payment amount than a total amount to be paid over time.

Recurring Schedule Start Day Picker

Recurring Schedule Start Day Picker is a recurring payment configuration option that enables users to start a recurring schedule on a specific day as opposed to a specific month when the recurring frequency is set to weekly or biweekly.

Highlights

- Substitute a start day picker for a month year picker when the recurring frequency is set to weekly or biweekly

- Place fences around the start of a recurring schedule by defining a min and max number of days

How does it work?

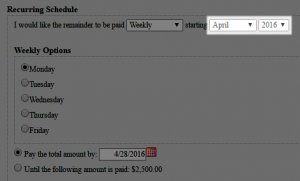

When the new start day picker is disabled, a user specifies the start of a recurring schedule by picking a month and year:

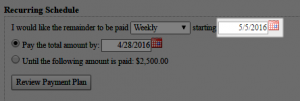

When the new start day picker is enabled, a user specifies the start of a recurring schedule by picking a day.

When a min and max has been configured, the system will restrict the start day and grey out restricted days within the calendar view.

Use Cases

The new configuration option was originally designed as a solution for an automobile finance company who wanted to both take down payments and enroll customers in auto debit at the time of loan origination. The new recurring schedule day picker enables the start of the recurring schedule to be set-up independently from the down payment. We anticipate the new configuration option will be useful for other finance companies who wish to setup both down payments and auto debit enrollments from a single user interface.

First Payment Date Min/Max

First Payment Date Min/Max is a new configuration option that enables merchants to place fences around the first payment date in a series.

How it works?

As with the Recurring Start Day Picker, when a min and max has been configured the system will restrict the start day and grey out restricted days within the calendar view.

Use Cases

The new configuration option was originally designed as a solution for an automobile finance company that wanted to restrict users from future-dating a down payment on a loan. We anticipate the new configuration option will be useful for other companies who wish to setup both down payments and recurring payments from a single user interface.