Trends in Auto Financing

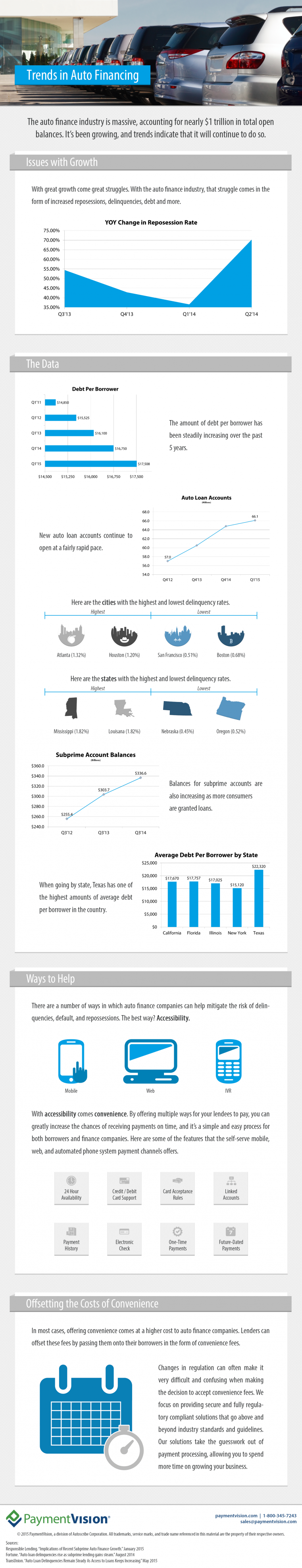

The auto finance industry is massive, accounting for nearly $1 trillion in total open balances. It’s been growing, and trends indicate that it will continue to do so.

With great growth come great struggles. With the auto finance industry, that struggle comes in the form of increased repossessions, delinquencies, debt and more.

The amount of debt per borrower has been steadily increasing over the past 5 years. New auto loan accounts continue to open at a fairly rapid pace. Balances for subprime accounts are also increasing as more consumers are granted loans. Additionally, when going by state, Texas has one of the highest amounts of average debt per borrower in the country.

There are a number of ways in which auto finance companies can help mitigate the risk of delinquencies, default, and repossessions. The best way? Accessibility.

With accessibility comes convenience. By offering multiple ways for your lendees to pay, you can greatly increase the chances of receiving payments on time, and it’s a simple and easy process for both borrowers and finance companies. Displayed within the infographic are some of the features that the self-serve mobile, web, and automated phone system payment channels offer.

In most cases, offering convenience comes at a higher cost to auto finance companies. Lenders can offset these fees by passing them onto their borrowers in the form of convenience fees.

Changes in regulation can often make it very difficult and confusing when making the decision to accept convenience fees. We focus on providing secure and fully regulatory complaint solutions that go above and beyond industry standards and guidelines. Our solution takes the guesswork out of payment processing, allowing you to spend more time on growing your business.