The Basics of Hosted Tokenization

Hosted Tokenization: Learn about the basics behind tokenization – the solution that keeps your customer’s data safe and secure while reducing your compliance risks.

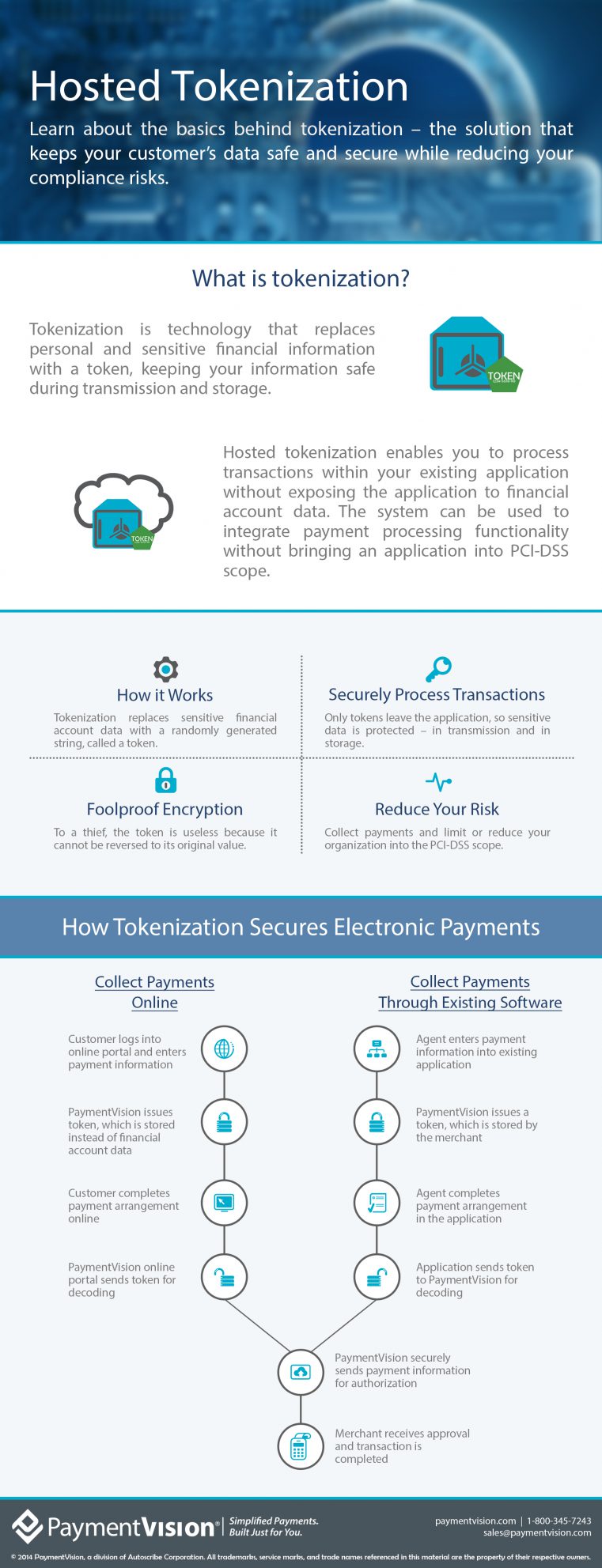

What is tokenization? Tokenization is technology that replaces personal and sensitive financial information with a token, keeping your information safe during transmission and storage. Hosted tokenization enables you to process transactions within your existing application without exposing the application to financial account data. The system can be used to integrate payment processing functionality without bringing an application in to PCI-DSS scope.

How it Works Tokenization replaces sensitive financial account data with a randomly generated string, called a token.

Securely Process Transactions Only tokens leave the application, so sensitive data is protected – in transmission, and in storage.

Foolproof Encryption To a thief, the token is useless because it cannot be reversed to its original value.

Reduce Your Risk Collect payments and limit or reduce your organization into the PCI-DSS scope.

How Tokenization Secures Electronic Payments After entering payment information, PaymentVision issues a token, which is followed by the completion of the arranged payment. The token is sent back to PaymentVision for decoding, who then securely sends the payment information for authorization. Lastly, the merchant receives approval, and the transaction is completed.