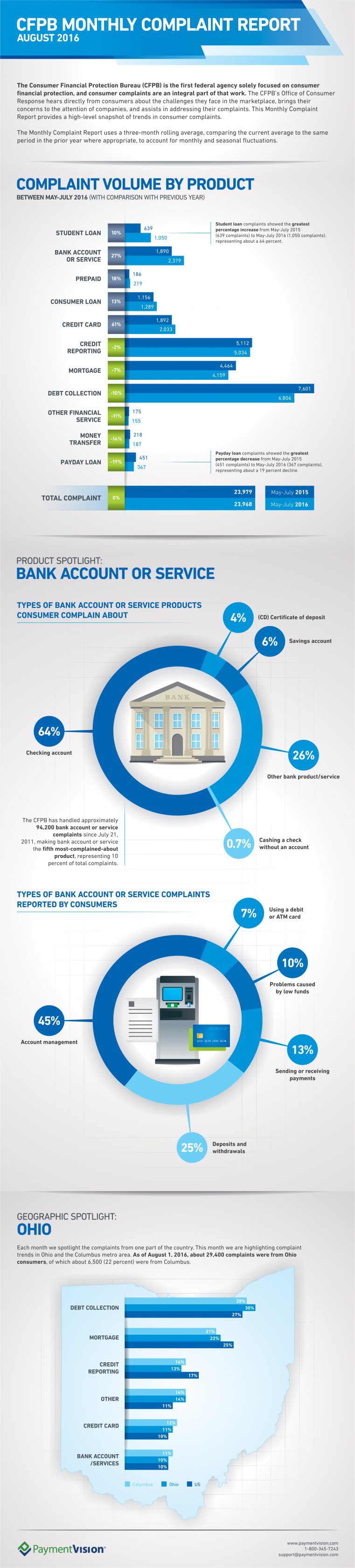

CFPB Monthly Complaint Report – August 2016

The management of any type of consumer loan product can cause a complaint. The constantly evolving financial markets continue to develop new ways to provide a ready cash supply to anyone who needs it. In many respects, the old style of lending and borrowing money – typically from a bank to an account holder – has been superseded by digitally managed transactions, where there has been no development of a mutually trusting relationship. Very often in these transactions, the borrows are not able to secure a loan from a more traditional lender and enjoy the borrowing benefit offered by the non-traditional lender.

However, sometimes these lenders impose steep fees or onerous collection tactics on their customers that exceed the legal boundaries of their industry. The Consumer Financial Protection Bureau (CFPB) has been fielding complaints about all varieties of consumer loan products since 2012. Their August 2016 report reveals which of these lending industries are doing well by their customers, and which are not.